Building and Managing a Survey Panel

Making critical business decisions on bad data is like trying to navigate a new city with a map from the 1980s. It’s slow, frustrating, and you’ll probably end up in the wrong place. Many companies try to solve this by blasting surveys to wide, generic audiences, only to get back low-quality, uninspired feedback. There is, however, a more professional approach: building a survey panel.

According to research by McKinsey, companies that consistently leverage customer insights outperform their peers by a staggering 85% in sales growth. A dedicated survey panel is one of the most powerful ways to generate those insights on demand. But is it the right move for you?

This isn't another article that just defines the term. We'll get straight to the point, breaking down the pros and cons from the perspective of people who build products and need answers fast. We’ll cover what a survey panel really is, the benefits that advocates rave about, the hidden costs and headaches they don’t, and help you decide if building one is a strategic move or a costly distraction.

Table of Contents

- What Exactly Is a Survey Panel?

- The Case FOR Building Your Own Survey Panel (The Pros)

- The Case AGAINST Building Your Own Panel (The Cons)

- How to Build a Survey Panel (The 5-Step Framework)

- The Verdict: Is a Survey Panel Right for You?

What Exactly Is a Survey Panel?

In simple terms, a survey panel is a pre-recruited group of individuals who have agreed to participate in ongoing research studies. Think of it as a focus group on speed dial, a private community of your most engaged customers, users, or prospects ready to provide feedback when you need it.

These individuals—called respondents—are typically profiled based on demographics, behaviors, and other criteria, allowing you to target your research with incredible precision. This is the key difference between a panel and just sending a survey to your email list. A panel is a curated asset; an email blast is a shot in the dark.

There are two main flavors of survey panels:

- Third-Party Panels: These are managed by market research firms who rent out access to their massive, pre-built communities of respondents. It's fast, but can be expensive and the quality can be a mixed bag.

- Proprietary (or In-House) Panels: This is a panel you build and manage yourself, composed of your own customers, users, or a specific target audience. It’s your private intelligence network.

For the rest of this article, we’ll focus on the big question: should you invest the effort in building your own proprietary survey panel?

The Case FOR Building Your Own Survey Panel (The Pros)

Building an in-house panel is a serious commitment, but the advantages can be immense, especially for product-led companies.

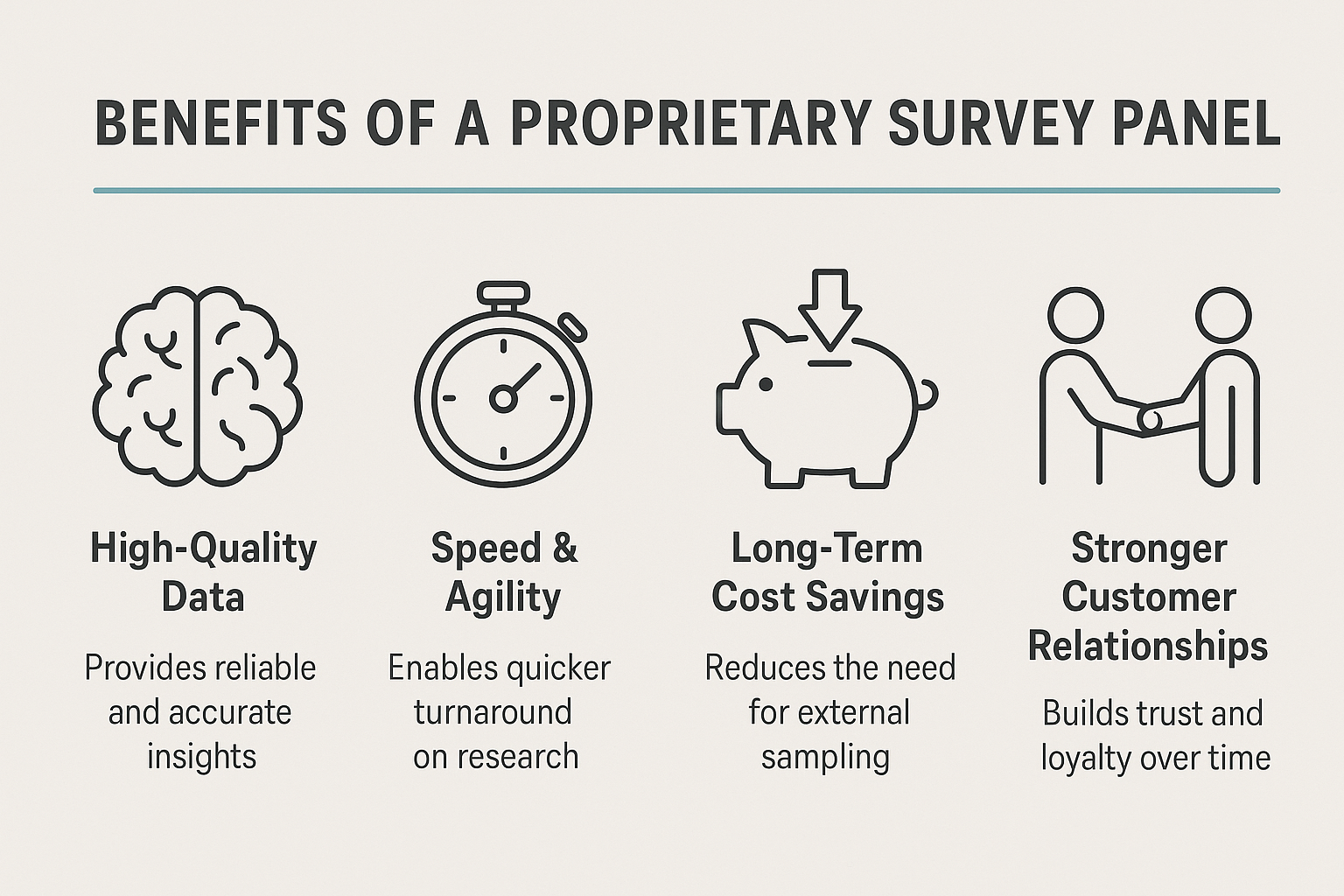

1. Unmatched Data Quality and Richness

When you survey random people, you get random-quality data. Respondents may rush through questions just to get the incentive. With your own panel, you cultivate a community that is genuinely invested in your product's evolution. The feedback is more thoughtful, detailed, and trustworthy. You can also conduct longitudinal studies—tracking the same group's opinions over time—which is nearly impossible with ad-hoc surveys.

2. Incredible Speed & Agility

As indie hackers, we know that speed is everything. When you have a question about a new feature, you can't afford to wait two weeks for a traditional research agency. With a proprietary panel, you can design a survey in the morning and have actionable data by the afternoon. This allows for rapid iteration and validation, which is a massive competitive advantage.

3. Long-Term Cost-Effectiveness

Let's be clear: the upfront cost is higher. But the per-survey cost plummets over time. While competitors are paying hefty fees for every single response from a third-party panel (seriously?), you are leveraging an asset you already own. Over dozens or hundreds of feedback cycles, the ROI becomes undeniable.

4. Deeper Customer Relationships

A panel isn't just a list of emails; it's a community. By regularly asking for their opinions and showing them how their feedback is shaping the product, you make these customers feel valued and heard. This builds incredible loyalty and turns users into advocates. It’s a direct line to the people who matter most.

The Case AGAINST Building Your Own Panel (The Cons)

If panels are so great, why doesn't every company have one? Because it's hard. The reality is that the management overhead can be a significant drain if you're not prepared.

1. Significant Upfront Investment (Time & Money)

Building a quality panel isn't a weekend project. Recruitment takes time and resources. You need to find the right people, screen them, and onboard them. Then there's the cost of the platform to manage them and the incentives (cash, gift cards, or discounts) to keep them engaged. Every hour spent on panel logistics is an hour not spent building your core product.

2. The Risk of Panel Fatigue & Bias

If you survey the same people too often, two things can happen. First, panel fatigue: they get tired of your requests and their response quality drops. Second, conditioning bias: they become "professional" survey-takers who start giving you the answers they think you want to hear, rather than their honest opinions. Managing this requires careful planning and rotation.

3. The Management Overhead is Real

This is the hidden killer. A panel needs constant care and feeding. You are responsible for:

- Recruitment & Onboarding: Finding and welcoming new members.

- Communication: Keeping the community engaged even when there isn't an active survey.

- Incentive Fulfillment: Making sure everyone gets paid on time.

- Data Hygiene: Removing unresponsive or low-quality members.

This is exactly the kind of soul-crushing administrative work we built FormLink.ai to eliminate from the survey process itself. Managing a panel adds another layer of complexity.

4. Recruitment is Harder Than It Looks

Finding 100 people is easy. Finding 100 of the right people who are also articulate, reliable, and representative of your target market is incredibly difficult. It requires a clear strategy and a compelling reason for them to join.

How to Build a Survey Panel (The 5-Step Framework)

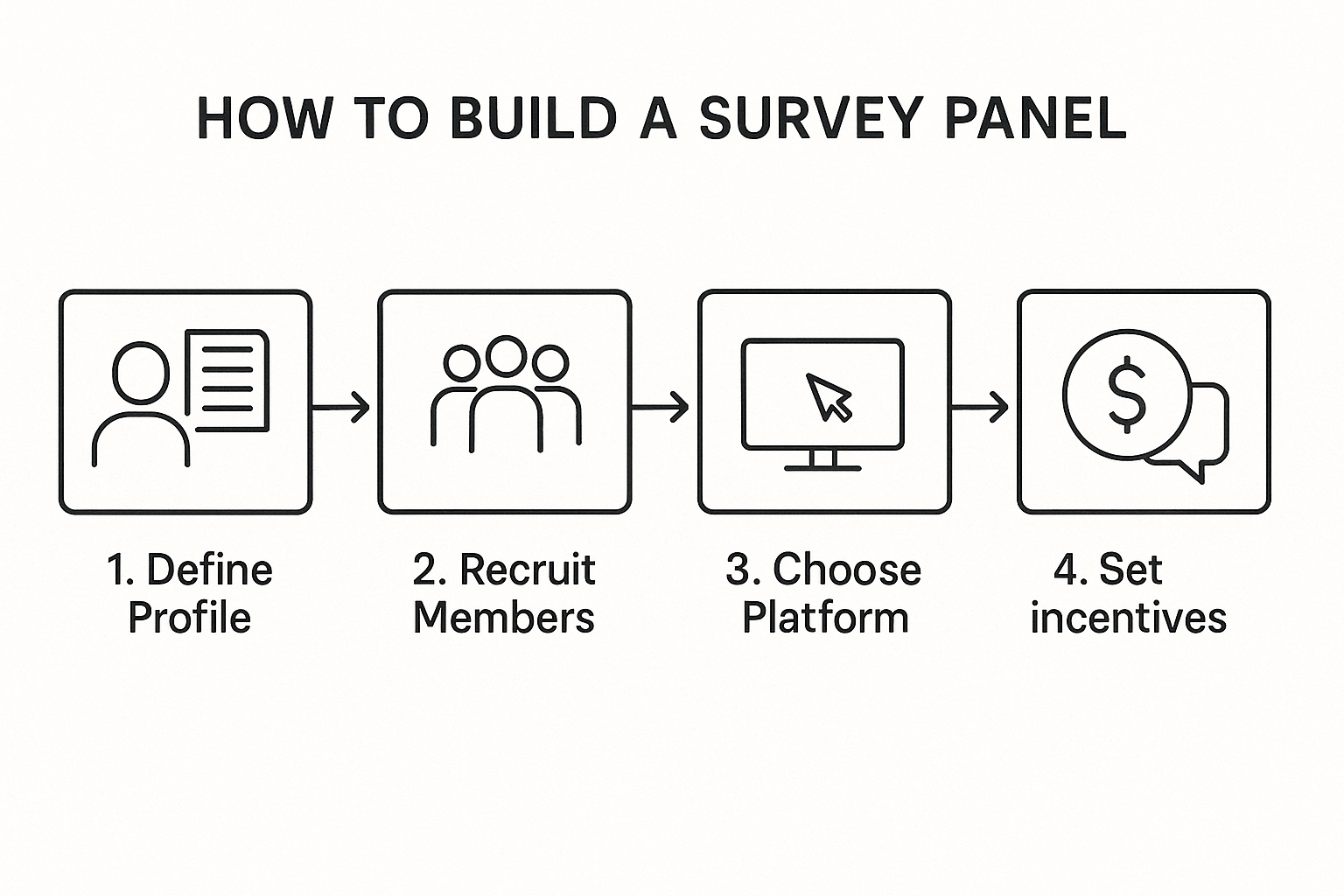

If you've weighed the pros and cons and decided to move forward, don't just jump in. Follow a structured approach. While we can't cover every detail here, this framework will get you started.

- Define Your Ideal Respondent Profile: Get hyper-specific. Don't just say "users." Is it "power users of Feature X who have been customers for 6+ months"? Or "marketing managers at B2B SaaS companies with 50-200 employees"? A clear profile makes recruitment 10x easier.

- Choose Your Recruitment Channels: Where do these people hang out? You can recruit from your existing customer email list, use a pop-up on your website, post in private communities (with permission), or run targeted ads on social media.

- Select the Right Platform: You need a home base for your panel. You could try to stitch together spreadsheets and email clients, but you'll quickly regret it. You need a tool that can handle member profiles, survey distribution, and reminders. When it comes to the surveys themselves, using a tool that provides an engaging survey experience is critical to keeping your panel happy.

- Create a Fair Incentive Program: Your panelists' time is valuable. Decide how you will reward them. Common incentives include points redeemable for gift cards, direct cash payments, or exclusive discounts on your product. The key is consistency and reliability.

- Engage, Engage, Engage: The biggest mistake is treating your panel like an ATM for data. It's a community. Send them newsletters, share the results of studies they participated in (show, don't just tell), and create a sense of belonging.

The Verdict: Is a Survey Panel Right for You?

So, should you build a survey panel?

- You SHOULD consider it if: You are a product-led company that relies on a continuous stream of high-quality user feedback to iterate and grow. You have the resources for the initial investment and see it as building a long-term strategic asset.

- You should probably AVOID it if: You only need feedback sporadically (a few times a year). You are a very early-stage startup where every hour of focus must be on the core product. The cost and management overhead would be a harmful distraction.

For many, the right first step isn't to build a full-blown panel, but to simply get better at gathering high-quality feedback from the users you already have. Start by replacing your clunky, boring surveys with modern, conversational forms. Once you've perfected the art of asking, you'll be in a much better position to decide if you need your own private community of respondents.

More Resources

- Forrester: The Five Steps To Build A Customer Insights Engine: A high-level look at creating a system for insights.

- Principles of Survey Methodology (PDF from Stanford): A deep, academic dive into what makes survey data valid and reliable.

- FormLink.ai: AI Forms: Learn how an AI-native approach can improve the quality of the feedback you collect.